Elliott Gaspar, Founding UK Director of Standard Ledger UK and one of our trusted mentors in the Funding Accelerator programme, recently led a workshop with our community of startup founders. The focus? Financial reporting – how it evolves as your business grows, and what kind of financial insights business investors like to see once your startup secures angel investment.

In the session, Elliott delved into the early stages of a startup’s journey, where it’s fairly typical to be focused on cash flow – what money comes into the business, and what goes out. As a business matures and secures funding, the spotlight shifts to more sophisticated financial reporting. This is typically in the form of a 3-statement financial model, complete with an Income Statement, Balance Sheet and Cash Flow Statement.

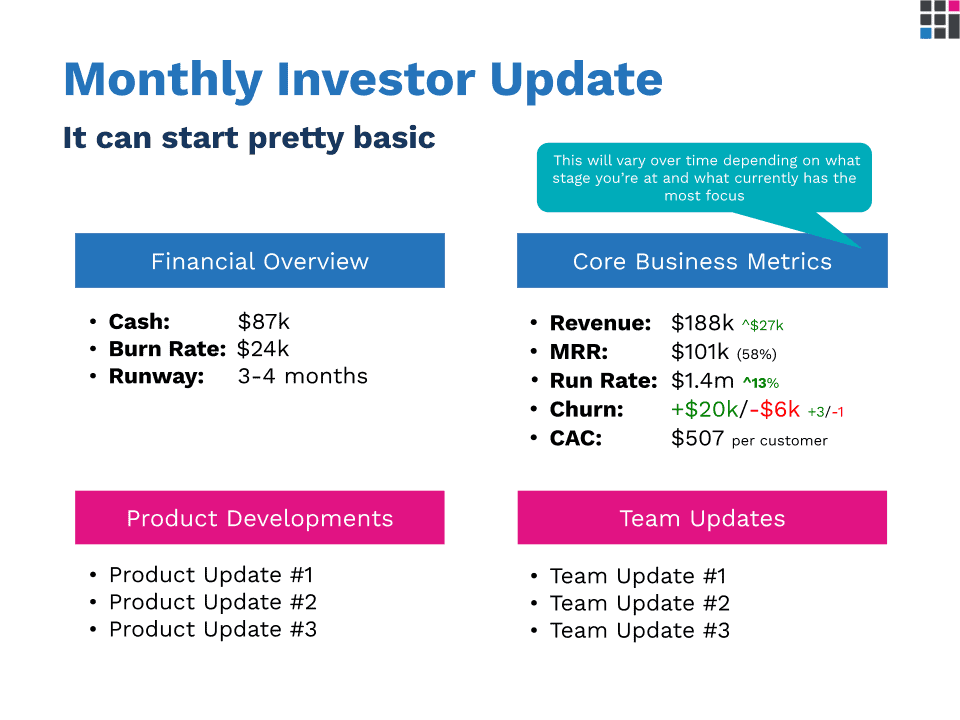

But fret not, this transition doesn’t necessarily need to happen overnight. Elliott shared his top tips on how to manage financial reporting post-investment, including how to strike that sweet spot – providing investors with just the right amount of information to keep them clued in about the company’s financial pulse.

3 Areas to Cover in Financial Reporting for Investors

1. Key Financial Metrics

When it comes to financial reporting, the metrics you share with your investors depend heavily on the nature of your business. Elliott breaks it down for us, highlighting some key numbers that most investors are keen to see:

- Cash: How much cash you’ve got sitting in your bank account right now. It might also include any outstanding invoices and when you expect that money to roll in.

- Burn rate: How much money you’re spending each month.

- Runway: How many months you have until your business runs out of money if you don’t bring in any more sales. You can calculate this by dividing your current cash in the bank by your monthly burn rate, which will give you the number of months left in your runway.

2. Company Metrics

Elliott also recommends integrating Key Performance Indicators (KPIs) into your financial reports for business investors. The choice of metrics you include largely hinges on your business type; for instance, an ecommerce company might prioritise Average Order Value, while a subscription-based business might spotlight renewal or churn rates.

At a high level, your company metrics should communicate these types of metrics when doing financial reporting:

- Revenue: How you show this may be different depending on your business type. You might opt for a top-level monthly revenue figure. If your business operates on multiple revenue streams, you could differentiate between recurring revenue (annual and/or monthly) and one-time revenue. Alternatively, investors may appreciate the breakdown between new and renewed revenue, or different customer bases. Including the monthly revenue figure alongside the current annual run rate provides investors with a snapshot of your progress for the year.

- Churn: If you’re in the SaaS industry, it’s likely you’ll have a subscription-based business model, so the percentage of customers leaving (or renewal rates) may be another key metric to communicate in financial reporting.

- CAC (Customer Acquisition Cost): How much it currently costs you to acquire a new client. It involves dividing the amount spent on sales, marketing and advertising by the number of new customers gained within a specific time period.

3. General Contextual Updates

In addition to keeping business investors up-to-date on financial reporting and KPIs, Elliott also recommended providing contextual updates about the business, particularly focusing on these key areas:

- Product: Keep investors in the loop on how the product is evolving, any new product lines, and the issues you may be encountering along the way.

- Team: Highlight recent key hires or leavers, as well as any new additions to the board of advisers.

- Marketing: Share updates on new partnerships or markets the business is venturing into, along with insights into what’s working well and what’s not.

These contextual updates help to give investors a feel of what is really happening in the business, in addition to the financial reporting and KPI metrics. Additionally, this part of the update serves as an opportunity to flag any challenges your business may be experiencing, and outline your plans for overcoming them, ensuring investors feel well-informed and engaged.

Tailoring Financial Reporting to Investor Preferences

The frequency and complexity of financial reporting shared depend on the investor’s preferences and level of involvement. According to Elliott, investors serving on the board typically expect monthly financial updates. On the other hand, less engaged investors may find quarterly reports sufficient.

If the business is experiencing issues with cash flow, investors may request a detailed 13-week forecast. This forecast, possibly broken down on a weekly or even daily basis, offers insights into precise cash pinch points, helping investors to understand the financial landscape more comprehensively.

Bonus Tip: Outsource Bookkeeping & Embrace Accounting Software

In the early stages, it’s common for founders to handle financial reporting using spreadsheets. However, Elliott suggests making the switch to accounting software like Xero or QuickBooks as soon as possible. This move sets you up for success in the long run, especially as you transition to more complex financial reporting.

What’s more, Elliott also recommends finding the right balance between cost-saving and time-saving measures. While managing your own books initially can conserve cash flow, it may consume valuable time. As your business expands, outsourcing bookkeeping and other tasks could prove to be the optimal solution, freeing up time to focus on product growth. The earlier you bring in bookkeepers and accountants, the easier it will be to keep data input standardised, which will help significantly when financial reporting becomes more intricate.

Want to know more about the 3 unit metrics that attract business investors? Read more here.

Interested in connecting with mentors to enhance your investment positioning, refine your growth strategy, or boost your confidence? The Funding Accelerator programme connects you to our extensive network of over 60 mentors who provide feedback on your investment plans and offer one-to-one sessions in their specialism to boost your likelihood of raising investment.

If you’re looking to enhance your financial reporting practices post investment, don’t hesitate to reach out to Elliott Gaspar and the team at Standard Ledger UK and book a free, no-obligation chat.

- Founders’ Negotiation Tactics: How To Secure The Best Startup Valuation - May 12, 2025

- How To Master Your Sales Lifecycle: Close Deals Faster And Smarter - April 30, 2025

- How To Maximise Your Business Valuation And Attract Investors - April 7, 2025