Jennifer Clamp, founder of Aata, and one of our trusted mentors on our Funding Accelerator programme, recently led a resilience training workshop on how to build resilience when fundraising.

Life as a founder can be full of knocks and challenges – and hopefully many highs as well. So much so, leading a start-up is often described as a “rollercoaster” experience, and for good reason – the highs are exhilarating and motivating, whilst the lows can be stressful, and all-consuming.

In a recent resilience training workshop Jennifer gave our founders a variety of different tools and techniques to help build resilience and thrive – as opposed to just surviving – in stressful situations and environments.

We summarised some of the strategies discussed to help you approach fundraising with confidence, clarity, and courage!

1. Master Energy Management

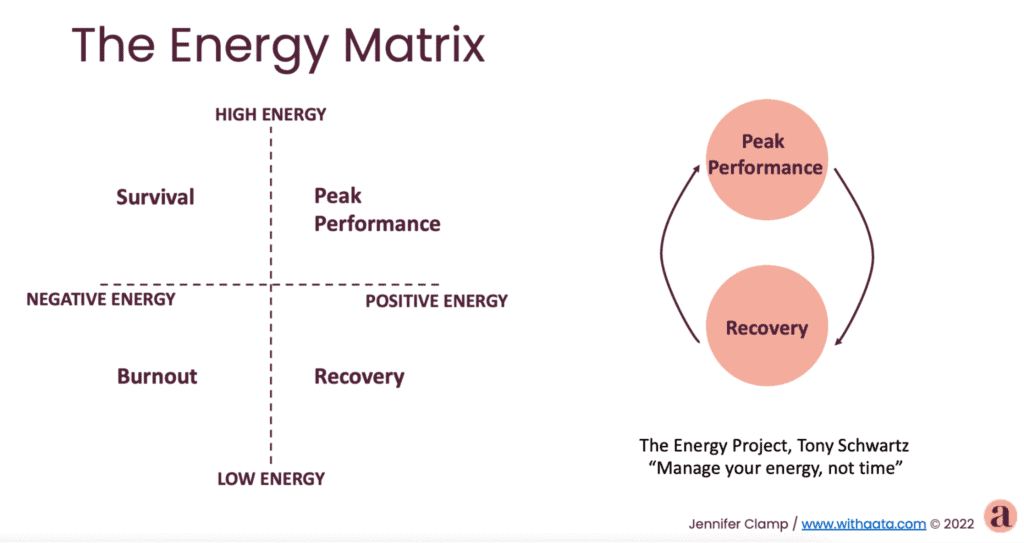

To start, Jennifer discussed how our energy levels have a direct impact on our performance and the ability to make decisions, and shared with our founders the “Energy Matrix”. The matrix illustrates the four zones of energy: peak performance, recovery, survival mode, and burnout.

Jennifer explained that whilst you want to spend as much time in ‘peak performance’ where you have high, positive energy, this is unsustainable. So, there has to be periods of time spent in ‘recovery’ where your energy is lower but still positive. This is important because having periods in ‘recovery’ allows us to move back into peak performance, and avoid transitioning into ‘survival’ mode which can then lead to burnout.

Here are some practical tips Jennifer recommends to manage your energy effectively.

- Identify your preferred conditions and activities for recovery.

- Prioritise the “physical energy trio” – adequate sleep, regular exercise, and a balanced diet.

- Be conscious of your energy levels in a day, and across a week, and schedule difficult activities when you have more energy.

- Identify and make time for an “opposite world” activity, which is an activity or hobby that puts you in the direct opposite mindset to your work, and recharges you. More on this below!

2. Harness Positive Emotions

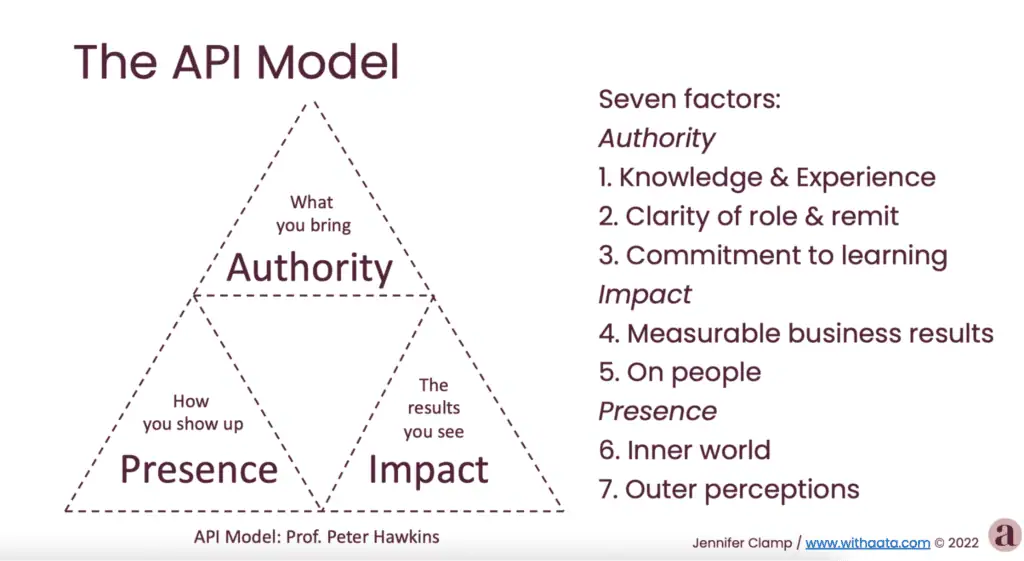

Jennifer then asked our community of founders to think of specific examples in their fundraising experience where they have felt positive and negative. Positive emotions, such as feeling confident, are crucial for maintaining composure and calming your nerves in pressurised and challenging situations. Jennifer introduced the concept of the API (Authority, Presence, and Impact) model that can help you cultivate trust, confidence, and a positive mindset during the fundraising process.

Practical tips:

- When you’re not feeling positive, use the seven factors of the API model to identify ‘why’ and put in strategies for improvement e.g. you might not be feeling positive about fundraising because you may feel you don’t have knowledge and experience of the fundraising process, so you know to build knowledge to develop a strong strategy.

- Gather evidence in each of the 7 areas to support your feeling confident and building trust with investors, such as knowing your Impact by using KPIs, growth rate etc

- Use the seven factors to understand what others need to feel confident in you, seek their feedback and use the data you have gathered to address any gaps.

3. Respond with Intention

In high-pressure moments, Jennifer explained that it’s easy to react impulsively, but explained that being resilient involves consciously choosing how you respond. She used the E+R=O (Event + Response = Outcome) formula to illustrate that you have a choice when an event or situation triggers you. By pausing and maintaining your composure, you create space to choose your response based on the outcome you would like, and then respond accordingly (as opposed to reacting).

Practical tips:

- When triggered, practice calming techniques like deep breathing, counting, focus on something intently, or tactile grounding exercises like rubbing fingers together to calm your nervous system.

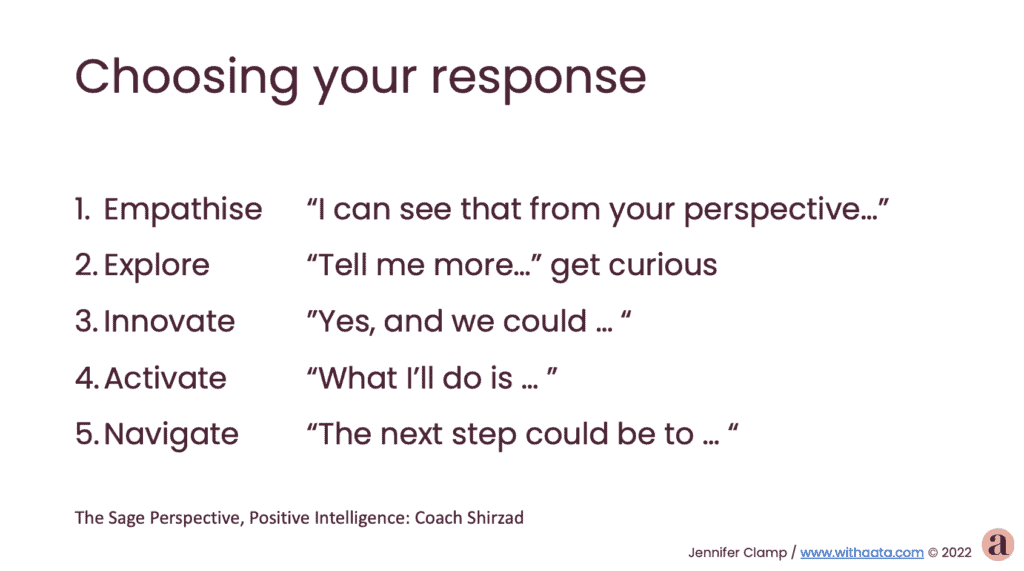

- Adopt the “Sage” approach by responding with empathy, exploration, innovation, activation, or navigation responses (see examples below).

- Anticipate potential triggers for panic, anxiety or nervousness, and practise your mindful techniques and how you will create a pause and calm yourself in order to respond.

4. Establish an Opposite World

Jennifer also recommended engaging in an “opposite world”, which as she described, are hobbies or activities that provide a complete mental shift from your work, to help you avoid burnout and recharge your batteries. Nick Petrie’s research suggests that individuals who have an “opposite world” are better equipped to thrive in high-stress environments than those that don’t.

Practical tips:

- Identify activities that put you in a mindset opposite to that of your work, such as physical exercise, artistic hobbies e.g. playing an instrument, spending time in nature e.g. gardening, or with animals.

- Fully immerse yourself in these activities, be present, and don’t distract yourself with work.

- Schedule regular breaks to engage in your “opposite world” activities.

5. Nurture Self-Compassion

The fundraising journey can be emotionally draining, and Jennifer emphasised the importance of speaking to yourself in a kind – and non self-critical way – to create positive emotions. Setbacks and challenges are a natural part of the process, and so it’s important to recognise that, and avoid any harsh self-criticism or negative self-talk.

Practical tips:

- Practice self-kindness by speaking to yourself as you would a close friend or loved one.

- Remind yourself frequently that difficulties are part of the entrepreneurial journey.

- Try to have a balanced perspective, and avoid over-identification with temporary setbacks.

6. Building a Support Network

Resilience doesn’t mean going it alone. It’s important to surround yourself with a strong support network of mentors, fellow entrepreneurs, friends, and family who can provide encouragement, advice, and a listening ear during challenging times.

Practical tips:

- Build a network of mentors who have navigated the fundraising process successfully.

- Join a community of founders who understand the unique challenges you face when trying to fundraise.

- Don’t hesitate to lean on your support network when you need to decompress or gain perspective.

We hope these hacks will strengthen your resilience and help you to approach your fundraising campaign with a positive and proactive mindset. It’s important to remember that resilience is not about removing challenges, but it’s instead about developing inner strength and strategies to navigate them effectively. By prioritising your well-being, maintaining composure, and responding intentionally, you’ll increase your chances of securing the investment, and avoid burnout.

Ready to develop a strong fundraising strategy, whilst being supported by a community of like-minded founders and experienced mentors? Join our Funding Accelerator today to give you the knowledge and support you need to navigate fundraising.

- Looking For Funding? Here’s Your Step-By-Step Guide to Finding Startup Investors - October 7, 2024

- Part 2 – Financial Forecasting For Startups: How Much Money Do I Need? - September 16, 2024

- How To Make A Pitch Deck That Attracts Investors - September 10, 2024