Do you obsess about your Pitch Deck? Spending hours tweaking it to ensure it gives investors the information they need? Most founders do. A pitch deck – or investment deck – is usually the ‘go to’ document founders create when preparing to raise external funding for their business. The majority of the founders who join our Funding Accelerator have a pitch deck created in some form, and recognise that they need this to generate excitement in their investment opportunity.

But I think there is a more important document. It’s the document you use to get a meeting with an investor. Without a meeting there is no pitch – and your Pitch Deck never sees the light of day, so all you tweaking was a waste of time!

Some founders might consider sending a Pitch Deck in order to secure a meeting with an investor but I don’t recommend that. If you send the Pitch Deck to get a meeting, you’ve revealed your hand and an investor has no reason to meet you. And you want them to meet you because a meeting allows an investor to understand who you are. To see first hand your market knowledge, your customer understanding, your handle on the numbers. All the things that make you a credible founder.

Rather than send a pitch deck to secure an investor meeting you need a “teaser” document. A document that entices an investor to meet you – by revealing the highlights of your investment opportunity. But your “teaser” document plays another role too. It allows an investor to check that your opportunity meets their investment preferences. You could say it acts a bit like a CV when you are applying for a job. A CV introduces you, showcases your skills and experiences and gets you a job interview. A “teaser” document introduces the investment opportunity, showcases the traction you’ve built and entices an investor to meet you.

The “teaser” document is often overlooked by founders but I would argue it’s more important than a pitch deck. Sometimes called an Executive Summary, and also known as a ‘one-pager’, your “teaser” document is what gets you an investor meeting! I would estimate that less than 5% of the founders joining Funding Accelerator have created their exec summary when they join our programme, and many don’t even know they need one.

So why is the Executive Summary your most important investor document?

Put simply, it’s a short summary of your investment opportunity designed to entice an investor to meet you. Think of it as a taster of your pitch deck that highlights the main exciting points, but doesnt give everything away in one go. It’s often called a “one-pager” because it should ideally only be one page. Investors are busy people so you need to get their attention quickly. That means you need to be succinct, giving investors the headline information they need to:

- understand what the investment opportunity is

- confirm it meets their investment preferences and

- determine if they want to know more by meeting you.

Making your Executive Summary count

The Executive Summary should be the first investor document potential investors view about your business. First impressions count, and once you have identified investors the executive summary should be used to get investors excited about your investment opportunity.

Many founders share a pitch deck straight away, but investors are busy people and see hundreds of investment opportunities. A full pitch deck provides too much information in one go. Instead, it’s a better tactic to grab the attention of the investor with something that can be read in just a couple of minutes, and ‘hook’ the investors into finding more about your business. Once their attention has been piqued, you can then secure a first call or meeting to take investors through your pitch deck covering the missing pieces that weren’t included in the Executive Summary. A meeting gives investors a better understanding of you (as the founder), your business and the opportunity to ask questions.

What information should be included when writing your Executive Summary?

Finding the sweet spot between providing enough to grab investors’ attention, but not too much so they don’t have a reason to speak with you, is the balance that needs to be struck when creating your Executive Summary. Investors are individuals, so each will want to know different things about your business to weigh up if this is an opportunity they would like to invest in. There is, however, a checklist of key information that all investors want to understand before investing, and it’s important to include these when writing an Executive Summary.

Here are the 8 essential elements that should be included in every Executive Summary:

- An overview of the problem you are solving and how you solve it – in other words, a short description of what your business is and what it does

- Market Opportunity – this should introduce the ideal (“target”) customers for your business, show how you intend to market and sell to your customers, and provide a sense of the size of your market, including how much of the market you are trying to capture i.e. the Total Addressable Market (TAM), the Serviceable Addressable Market (SAM) and Specific Obtainable Market (SOM)

- Value Proposition – what you offer your customers, how this is different from your competition and how you monetise your business model (ie how you sell and price your products and services)

- Traction – Your chance to showcase the progress made and to highlight the key milestones achieved to date

- Team – Introduce the founder(s), key people in your senior team and any notable investors or advisors, and their skills.

- Financials – A summary of revenue achieved to date and forecasted growth across the next 3 or 5 years

- Your ask – How much you are looking to raise, how you will use those funds and the “runway” this will give your business

- Contact details – Clear and prominent ways to contact you in order to arrange a first meeting.

What information should not be included in your Executive Summary?

There are no hard and fast rules on what should be left out when writing an Executive Summary, one point that does raise debate is the company valuation. Most investors will want to understand how the investment opportunity is priced, and will want to know your valuation. The difficulty is that an unrealistic valuation can put investors off – so if you are unsure if your valuation is realistic – you will need to think carefully before including it! We believe you stand out as a very investable, credible founder if you have done the work required to reach a realistic valuation. The goal of the Exec Summary is to get investors interested and excited, and valuation is an important part of this. Not mentioning valuation reduces the appeal of the deal.

Investors will also be thinking about how they get a return on their investment, which means you need to show investors how they will be able to sell their shares (at a higher price than they bought them) at some point in the future. This usually implies an exit event. Not all founders have thought about this – or even realised they need to offer an exit to investors. You can leave it out of your Exec Summary but, if you do, you reduce the appeal of your investment opportunity.

The feature set of your product or solution is an area that can be left out of the Executive Summary. It’s good to explain in layman’s terms what your product / solution does, but the inner workings of the technology and specific features can be held for the pitch deck and conversations. With the Executive Summary you are effectively positioning your business as an exciting investable opportunity, rather than communicating the features and benefits of your product in detail.

Specific details around expenses and financial scenario planning is another area that can wait for the pitch deck and the financial forecast. Showing revenue and future milestones are important to include, however, to generate excitement about the opportunity.

Tips for creating an engaging Executive Summary

As well as choosing the ‘right’ information to include in your Executive Summary, you can also optimise the design of the Executive Summary so that it’s more engaging for an investor to read, and so the key information stands out and can be read quickly. Here are some tips for creating an engaging one-pager

- Use visual elements wisely – Include logos, icons, charts, and graphics to reduce the amount of reliance on text so the key information stands out and that data or key milestones can be communicated quickly. Remember a picture speaks a hundred words!

- Maintain consistent branding – Ensure your Executive Summary reflects your brand and there is consistency across all your investor documents,your product and your website.

- Prioritise readability – This may sound obvious, but choose a typeface that is clear and legible. Anything smaller than a 12 point font isn’t really going to cut it! Also make use of bullet points, headings, sub-headings to pull out key points and make text easier to scan and digest.

- Optimise for mobile viewing – Consider that investors may be reviewing documents on their phones, so use concise language, make paragraphs short, and check how visuals and text display on a smaller screen to make sure information still stands out effectively.

Executive Summary Examples

To help, we’ve put together some Executive Summary examples created by our Funding Accelerator graduates which you can see below.

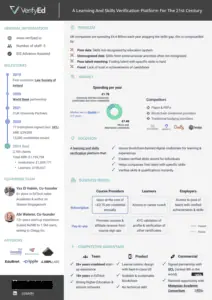

Here’s an example of an Executive Summary from a B2B Business:

An example of an Executive Summary from a B2C Business:

An example of an Executive Summary from a B2B2C business:

Next steps:

- Start writing your Executive Summary today. Request our free template.

- Have a question about your Executive Summary? Bring it along to our free online Funding Workshop.

- Want to gain feedback on your Executive Summary or your other investor documents? Join our Funding Accelerator.