Let’s talk about your pitch deck. Every founder knows they need one if they want to raise equity investment. Most founders have probably created one. But creating a pitch deck that will have investors clamouring to back your startup is a trickier task.

Deborah Gruenberger, founder of a design and marketing agency and angel investor, recently ran an engaging workshop for our community of founders on how to craft a pitch deck that really tells a story. It was packed full of practical tips to help our founders elevate their pitch deck from the hundreds of others that pass over investors’ desks each week.

We’ve summarised a few key takeaways from the workshop below and hope they help to make your pitch deck really shine!

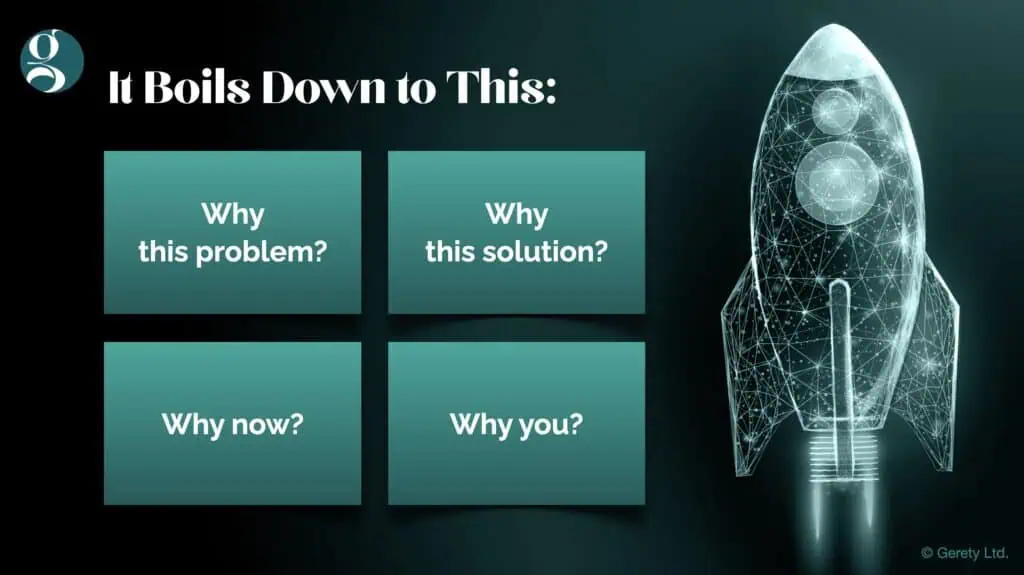

Focus on the Core Questions of a Pitch Deck

Deborah stressed that the basis of a good pitch deck really comes down to clearly answering four simple but crucial questions:

- Why this problem?

- Why this solution?

- Why now?

- Why you?

These questions help potential investors understand the necessity of your business, the timing and why you are the right person to solve this problem.

But, there are also three essential elements that every founder should focus on if you want your pitch deck to really stand out from the crowd:

- Storytelling

- Design

- Data

1. The Power of Storytelling

Most startups kick off their pitch deck by explaining what they do and how they do it. But, Deborah suggested framing your pitch around your purpose and mission before delving into how you solve the problem and what your product does. Remember that people invest in people. Connecting with investors on an emotional level and telling your business story in a compelling way is essential in a pitch.

Top Tip: Remember that investors are there to make money, so tell your story in the way they need to hear to believe in the business opportunity.

Real life example: Tony Eames, co-founder of Total Active Hub, recently revamped the Problem and Solution slides of his pitch deck to enhance storytelling. He achieved this by making the customer the central character and used their challenges and experiences to illustrate how Total Active Hub’s solution effectively addresses their clients problems. This fresh approach had some additional benefits, it helped bring the viral nature of their business to the forefront, which investors love to see. The storytelling allowed Tony to illustrate the positive network effects of their product; how positive customer engagement led to a powerful referral channel and was a catalyst for product adoption. Drawing out this growth potential is precisely what the storytelling aimed to do – generate excitement about the investment opportunity, and keep investors engaged.

2. The Importance of Design

Investors get sent hundreds of pitch decks every week, which means the time they spend looking at each one could only be a few minutes. Looking at a deck that’s messy or confusing might mean they switch off, or worse still, it might mean they discount the investment opportunity altogether. With our attention spans getting shorter and our brains able to process visual design 60 times faster than text, Deborah stressed it’s crucial to have a well-designed pitch deck to set yourself apart from others.

In order to achieve this, Deborah recommends using visual hierarchy, consistency in colours and imagery and keeping slides uncluttered to make your presentation more engaging and easier to follow.

Top Tip: Stick to one message per slide and use bullet points instead of full sentences to avoid clutter.

Real life examples: There are many design tools you can use to create a beautiful looking pitch deck. From Canva to Pitch.com. Pitch.com also put together this handy gallery of pitch deck examples from companies who have successfully raised — all of them have invested heavily into the design of their pitch deck slides.

3. Leveraging Data

Using data to back up your statements adds weight to your pitch. Deborah recommended incorporating various types of data to illustrate key points, particularly in areas like customer analysis, competitor analysis and your business metrics.

Deborah stressed that there are certain slides where data is a must-have. The traction slide and the market analysis (with TAM, SAM, SOM), are both examples where data should be used.

Both your progress and the market opportunity should be quantified, from primary data (= data you have collected yourself) or from secondary data (= data you found elsewhere). Including these data points and using a mix of data types means your story packs an extra punch and it gives a more robust view of your business and its potential.

Top Tip: Use a mix of qualitative and quantitative data to paint a full picture of your business’s potential and impact. Numbers are convincing, but stories about user experiences can be equally powerful.

Real life example: Another founder within our community leveraged data well in their go-to-market slides. After providing a birds eye view of their go-to-market strategy, they incorporated key metrics associated with each stage of a Marketing funnel into their pitch deck. This communicated to investors what traction they had already, what KPIs they track at different parts of their marketing funnel, and what their goals are for the future. Doing this gave investors confidence. Not only could they see they were the type of business that’s measuring in this way already, but also that they had clear measurable future goals to track success by.

Ready to Revamp Your Pitch Deck?

Creating a great pitch deck is about more than just rattling off facts about your business. It’s about telling a compelling story, having a clean design so it’s easy to engage with the story and using solid data to back up your claims and paint an exciting picture to investors.

If your pitch deck needs a bit of a makeover to bring out your story, improve the design, or add some oomph with strong data points, why not consider joining our Funding Accelerator? You’ll get access to all our mentors and be able to chat one-on-one with Deborah about your deck and how to make it even better.

- Founders’ Negotiation Tactics: How To Secure The Best Startup Valuation - May 12, 2025

- How To Master Your Sales Lifecycle: Close Deals Faster And Smarter - April 30, 2025

- How To Maximise Your Business Valuation And Attract Investors - April 7, 2025