Framing the issue – or societal/customer problem – that your startup is tackling, and how it solves that issue, acts as a hook to capture the attention of investors and get them nodding along in agreement with your pitch.

The ‘Problem’ and ‘Solution’ slides are commonly used at the beginning of pitch decks to help investors understand the essence of the business, and align the founders and investors on a shared vision for the startup. Founders often find creating these slides a challenge though, especially if the problem is complex or multifaceted where it’s hard to distill it into a concise and easily understandable format. This is also true if the solution is very technical, it can be a challenge to strike the right balance between providing the right amount of information without overwhelming investors with unnecessary complexity.

In a recent pitch idea swap we ran for our startup community, Funding Mastermind, we focused on the Problem and Solution slides of the pitch deck. Tony Eames, co-founder of Total Active Hub spoke about their challenges and how being so close to the business made it difficult to communicate what they did in a simple easy-to-understand way. They also explained that whilst they could find lots of evidence and stats about their problem, they struggled to quantify and show the impact of the problem on the businesses they were targeting. They also found that investors misinterpreted their solution so they needed a way to effectively explain how their solution is different to other startups operating in the same market. Perhaps you’ve experienced something similar?

All these factors led to Tony revising their approach to their problem and solution slides, going back to basics to help communicate better the impact of their problem and how their business is uniquely placed to solve it.

Here’s how they approached it.

Problem and solution slide 1: Setting the scene and quantifying the problem

For their first slide they focused on the key attention grabbing stats about the macro problems that exist in the industry they operate in, Health & Fitness. The aim was to communicate the problems still exist, even with the emergence of new technology, and how the problem has gotten worse over time. They also included stats on how this impacts businesses, specifically how much an inactive worker costs a business. This helped to position the problem, but also to demonstrate the ROI and the savings the business could make by adopting their solution.

Problem and solution slide 2: Demonstrating impact

After setting the scene they aimed to provide proof that their business helped to solve the problems they evidenced in the first slide.

In slide 2 they were able to show how they had impacted the workforce of the businesses they work with, and in turn what that delivered for the businesses themselves.

As the company had been established for a couple of years, they were able to draw from historical data to support their claims. They quantified and demonstrated confidently that they have made an impact, and showed in numbers the extent of that impact.

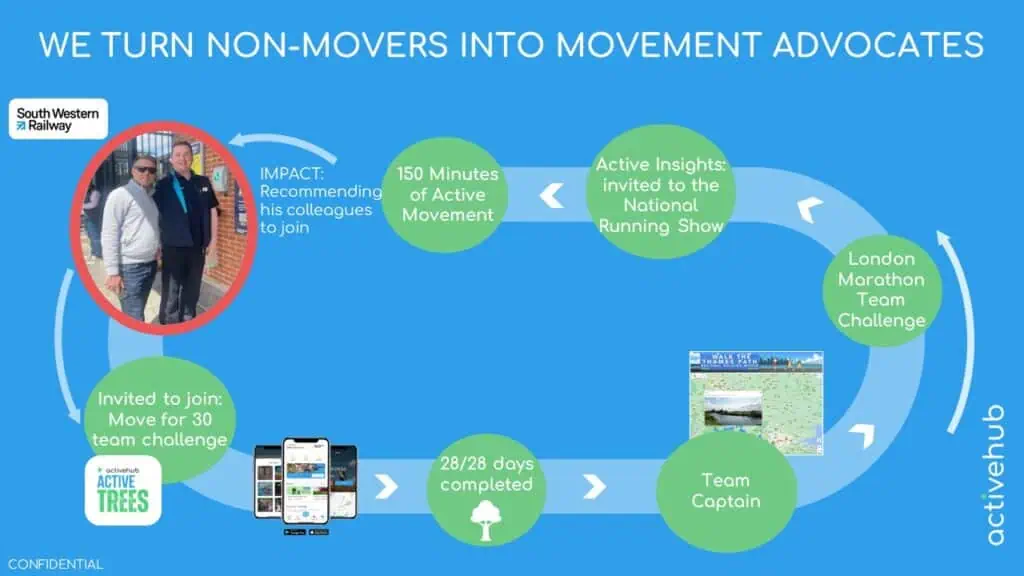

Problem and solution slide 3: The customer journey

After explaining the problem and quantifying how they solve the problem, the third slide went into more detail about what the company is and what they actually do. For this slide they used a customer journey to illustrate and put into context a users’ motivations and how they interact with their business.

For the customer journey they used an example of an employee at a real business that they partner with, and gave some context about the employees job role and lifestyle to set the scene. They then explained via a workflow how this individual was made aware of their startup and specifically what ‘product’ they engaged with. In this example the employee was asked by their employer to take part in an active challenge program. For each day that the employee was active, the company would plant a tree.

As part of the customer journey they explained the different interaction points the individual had with their technology. This provided the startup a good opportunity to communicate to investors what technology platform they are available on e.g. a web application (as opposed to a mobile application), why they chose that technology (in this example to reduce barriers of entry). It also gave the startup the opportunity to showcase some of the features of the product as they became more engaged with it e.g. the employee is able to track their progress on the challenge, and understand the impact of their progress (e.g. the number of trees that have been planted as a direct result of them engaging in the challenge). Through the customer journey the startup also showed the engagement insights they derived from the users’ activity, and how they used those insights to further enhance the experience for the user.

The customer journey also allowed the startup to demonstrate the viral nature of their business, something very attractive to investors. As the employee had a positive experience with a challenge it encouraged them to participate in more challenges and also meant they encouraged their co-workers to take part too. This word-of-mouth effect meant engaged users were acting as advocates for the startup. This powerfully demonstrated the network effect of the business and how positive engagement acts as a powerful referral channel, helping to increase the adoption of the product.

Problem and solution slide 4: Providing the wider context

The customer journey allowed the startup to explain what they do in a way that was easy to understand, and also gave just the right amount of detail for investors to really ‘get it’. For their final problem and solution slide they were then able to showcase their other Environmental, Social and Governance (ESG) and Corporate Social Responsibility (CSR) initiatives in a way that felt like a natural extension to their story.

In this slide they demonstrated how they are providing education days and proactively engaging with charities to complement their core offering, and give the employee and the business clear, measurable, incentives to work with them.

The results

The benefits of framing the Problem and Solution slides in this way were immediately evident. As well as helping to draw out the word-of-mouth effect of their product, the founders also found that the conversations and questions they had with investors when pitching also shifted.

Before implementing the changes, the founders discovered that their investors’ discussions revolved around addressing misunderstandings the investors had about their business.The customer journey made their business easy-to-understand, and as a result investor conversations changed. The conversations became more open. Investors quickly grasped the business, leading them to ponder, discuss, and ask questions about the opportunities and vast possibilities it holds, rather than focusing on operational details.

Using a customer journey is a straightforward and effective method to provide the optimal level of detail during pitches. The ‘Problem’ and ‘Solution’ slides play crucial roles in capturing investors attention and communicating the essence of the business, so it’s important to get them right to enhance the impact of your pitch and attract potential investors effectively.

For more suggestions on how to enhance your pitch deck, check out some further reading below.

Further reading

- Pitch deck: How to include your go-to-market strategy

- How to weave storytelling into your pitch deck to keep investors’ attention

- 3 unit metrics that attract startup investors and build a compelling story of growth

Ready to start your funding journey?

- Find out how attractive your business is to investors by answering 20 quick questions

- Bring your funding questions to our next free, online Funding Strategy Workshop

- Want some feedback on your pitch deck? Check out our Funding Accelerator

- Founders’ Negotiation Tactics: How To Secure The Best Startup Valuation - May 12, 2025

- How To Master Your Sales Lifecycle: Close Deals Faster And Smarter - April 30, 2025

- How To Maximise Your Business Valuation And Attract Investors - April 7, 2025