“Crowdfunding proved a brilliant way to market test a new product and boost sales” says Kellie Forbes Co-Founder of YUU World

Kellie Forbes and Gill Hayward, Co-Founders of YUU World, know what it takes to raise investment. They survived “Dragon’s Den” (TV programme) receiving offers from all five dragons and going on to raise investment from Peter Jones and Deborah Meadon. Then, in 2016, they raised £210,000 from a number of business angels. In 2017, with […]

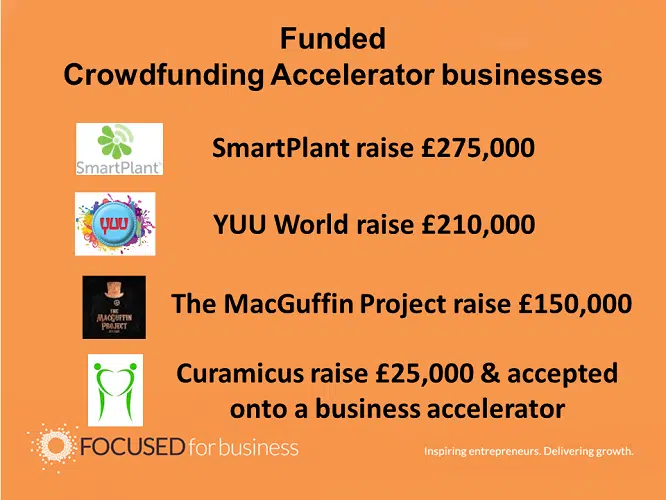

Crowdfunding Accelerator graduates raise almost £6600K of investment

Crowdfunding Accelerator graduates have raised almost £660K of investment for their businesses. They’ve all worked hard, done their homework and reaped the rewards. Congratulations to all our graduates. Crowdfunding Accelerator, an eight week online programme, makes it quicker and easier to prepare for crowdfunding, focusing your attention on the things that really matter. Is your […]

“Crowdfunding enabled us to turn a shared vision into a tangible financial commitment” says Robert Woodford, Marketing Director for Deep Time Walk

Schumacher College in Dartington, South Devon seeks to inspire, challenge and question people as co-inhabitants of the world. They are an international centre for nature-based education, personal transformation and collective action. They offer a range of residential courses on ecological themes and transformative courses for sustainable living. A number of co-creators from the college developed […]

Crowdfunding Success: “Momentum is the key to crowdfunding success” says Peter Ramsey, founder of Movem

Movem, the online community marketplace for landlords, agencies and tenants to list and review rental properties, raised £200,000 on crowdfunding site Crowdcube in just ten days (in August 2016). The investment allows Movem to expand into the residential lettings market, growing the business significantly. Hatty Fawcett, experienced crowdfunder and Founder of Focused For Business and […]