Accelerators: Your startup’s fast-track to growth? Accelerator alumni share their views

The number of accelerators has grown rapidly in recent years in the wake of big success stories from startups that have attended acceleartors – including AirBnB, Dropbox and Stripe. Crunchbasenow lists 534 Accelerator programmes in Europe alone. Is an accelerator your fast track to success? To get to the answer, I interviewed startup founders who […]

“Crowdfunding proved a brilliant way to market test a new product and boost sales” says Kellie Forbes Co-Founder of YUU World

Kellie Forbes and Gill Hayward, Co-Founders of YUU World, know what it takes to raise investment. They survived “Dragon’s Den” (TV programme) receiving offers from all five dragons and going on to raise investment from Peter Jones and Deborah Meadon. Then, in 2016, they raised £210,000 from a number of business angels. In 2017, with […]

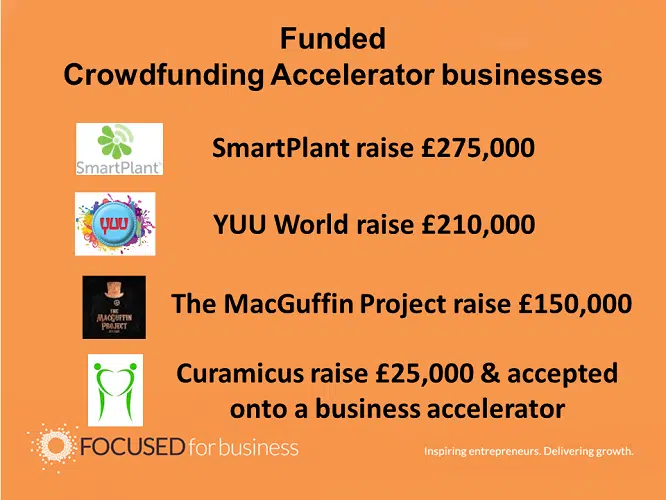

Crowdfunding Accelerator graduates raise almost £6600K of investment

Crowdfunding Accelerator graduates have raised almost £660K of investment for their businesses. They’ve all worked hard, done their homework and reaped the rewards. Congratulations to all our graduates. Crowdfunding Accelerator, an eight week online programme, makes it quicker and easier to prepare for crowdfunding, focusing your attention on the things that really matter. Is your […]

New crowdfunding regulation could make it harder to get accepted onto a crowdfunding platform

The Financial Conduct Authority (FCA) which regulates both peer-to-peer lenders and equity crowdfunding platforms has announced that it plans to introduce more regulation to protect potential investors and help them understand the risks of investing via crowdfunding. Areas likely to come under scrutiny include: more prescriptive requirements on the content and timing of disclosures better management […]

Why crowdfunding is like running a marathon…and how you can make it quicker and easier

The power of crowdfunding is undeniable. The media is full of stories of companies raising large amounts of money in just a few days, hours or even seconds! Brew Dog raised more than £7 million from three crowdfunding exercises Just Park raised £3.57 million in 34 days Mondo bank raised £1 million in just 96 […]