Today VC Firm Atomico launched their State of European Tech Report for 2022 which identifies trends in startup investment.

** Spoiler alert: The key findings make for rather bleak reading**

The report is focused on Venture Capital (VC) funding but there are some findings that early stage businesses need to be aware of too:

- Since July there has been a slowdown in startup investment. Total investment in Q3 2022 was more than 40% down on the same quarter in 2021.

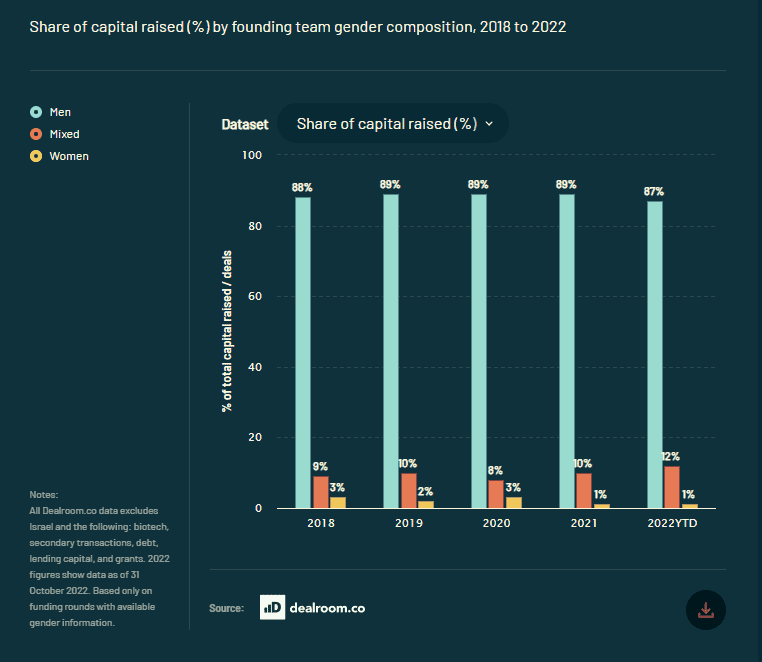

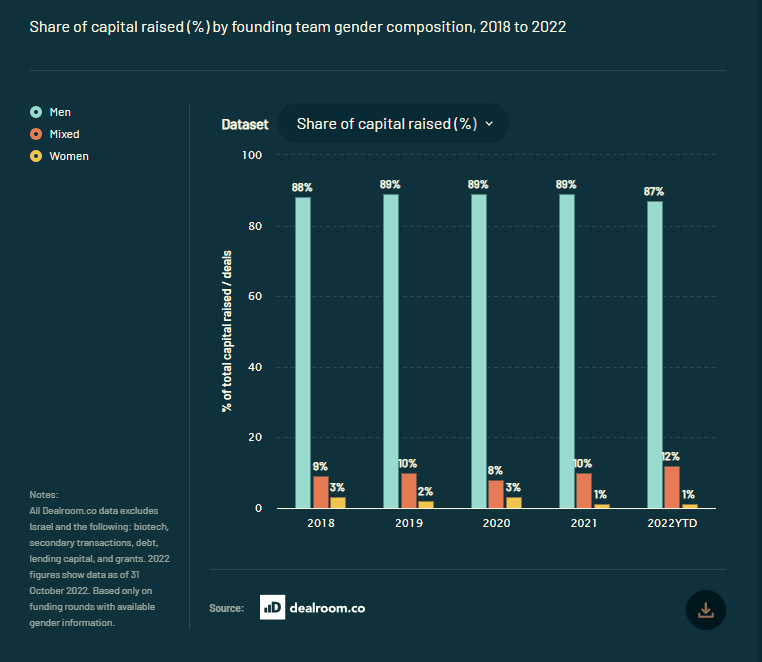

- The distribution of startup investment amongst diverse groups of founders makes for dismal reading. For example, 87% of VC funding goes to men-only founding team and investment in female founding teams have dropped from 3% in 2018 to just 1%.

- Startups are facing a double whammy with challenges when it comes to accessing funding and a challenging economic/sales climate too. Focus will be required to “weather the storm”

Reasons to be cheerful…

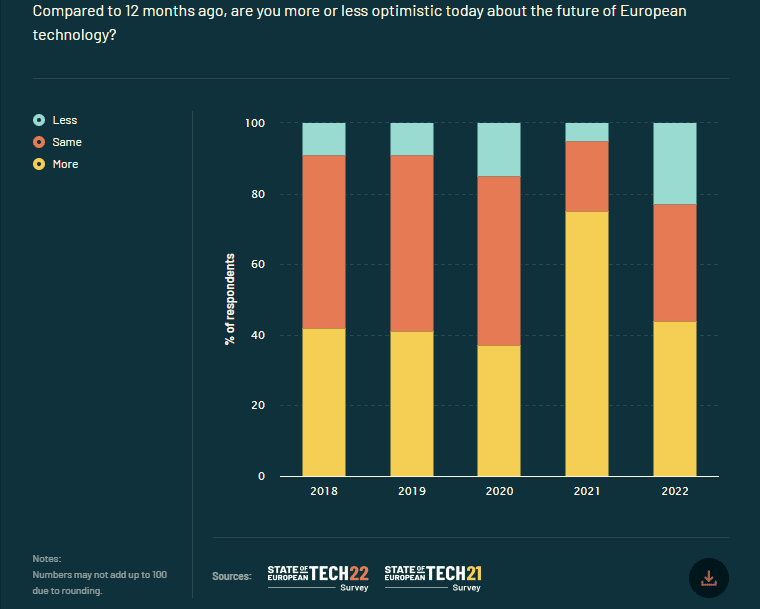

You could be forgiven for thinking it’s all “doom and gloom” and yet 77% of all survey respondents said they were either more optimistic or retained the same level of optimism as they did 12 months ago.

And that’s because most people recognise this is a short-to-medium term challenge. The long-term outlook for startups is unchanged. Investors are still out there, and levels of investment will increase over time. We need to prepare for a marathon, not a sprint and to do what we can to manage cash and monthly burnrates.

…especially for early stage startups

Now, this report focuses on the world of VC funding. Early-stage startup investment and angel investment is not immune to what is going on in the rest of the investment world, but it is a bit different.

The sums of money needed by early-stage start-ups to deliver growth are smaller than later stage businesses chasing VC investment.

The expectations of what a strong Return On Investment (ROI) looks like is different too. A VC, will require upwards of a 25x ROI, whilst angel investors are more likely to look at a 10x return.

There are still lots of high net worth, angel investors making investment – especially in businesses that are delivering change in our world and who can tell a strong story of traction and growth in making that change happen.

If you want to stand out and attract startup investment from investors, the key, right now, is to have a strong vision and a credible financial forecast that shows how you turn your vision into revenue and profit, despite the challenging climate.

Given founders are good at overcoming adversity, you could say it is “business as usual”!

My main take-away from today’s report is just how much work still needs to be done to level the playing field when it comes to raising investment.

The distribution of funding amongst diverse groups of startup founders makes for dismal reading. For example, 87% of VC funding goes to men-only founding team and investment in female founding teams have dropped from 3% in 2018 to just 1%.

Over a series of LinkedIn posts (the first of which is here) I will be addressing some of the key barriers that stop funders and founders finding each other, and I’ll be keen to hear your thoughts as we discuss them. At every opportunity I’d love people to comment, tag and share so we can start building more connections through our conversation. Do join the conversation on LinkedIn.

If you have questions about how you respond to the changed funding climate when planning your funding round, join me at a free Funding Strategy Workshop.