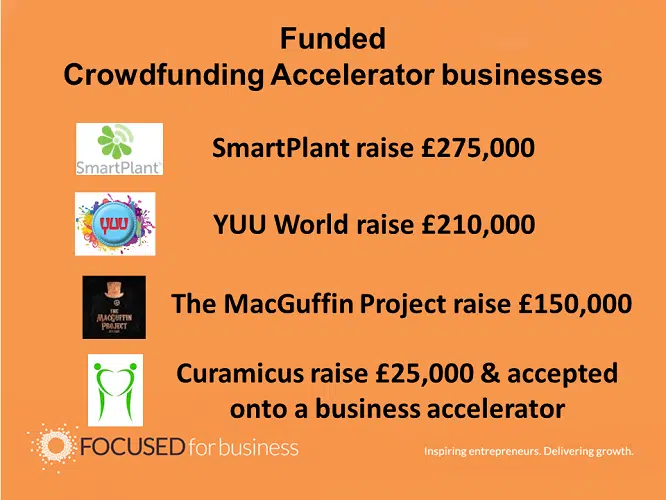

Crowdfunding Accelerator graduates raise almost £6600K of investment

Crowdfunding Accelerator graduates have raised almost £660K of investment for their businesses. They’ve all worked hard, done their homework and reaped the rewards. Congratulations to all our graduates. Crowdfunding Accelerator, an eight week online programme, makes it quicker and easier to prepare for crowdfunding, focusing your attention on the things that really matter. Is your […]

New crowdfunding regulation could make it harder to get accepted onto a crowdfunding platform

The Financial Conduct Authority (FCA) which regulates both peer-to-peer lenders and equity crowdfunding platforms has announced that it plans to introduce more regulation to protect potential investors and help them understand the risks of investing via crowdfunding. Areas likely to come under scrutiny include: more prescriptive requirements on the content and timing of disclosures better management […]